stock option sale tax calculator

The Stock Option Plan specifies the total number of shares in the option pool. Click to follow the link and save it to your Favorites so.

Capital Gain Calculator Estimate The Tax Payable Scripbox

Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the.

. How much are your stock options worth. Below we will dive into Alternative Minimum Tax and how it pertains to the most common trigger. Taxes for Non-Qualified Stock Options.

This permalink creates a unique url for this online calculator with your saved information. Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. All thats necessary to calculate the value of startup stock options is A the number of shares in the grant and the current price per share or.

Exercising your non-qualified stock options triggers a tax. Estimate the after-tax value of non-qualified stock options before cashing them in. Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire.

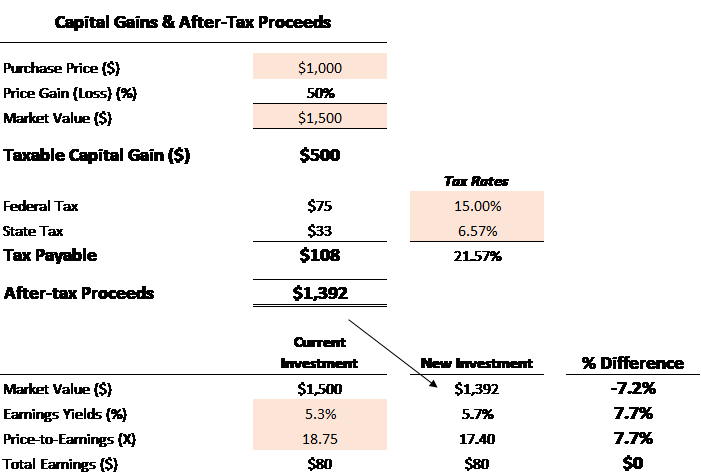

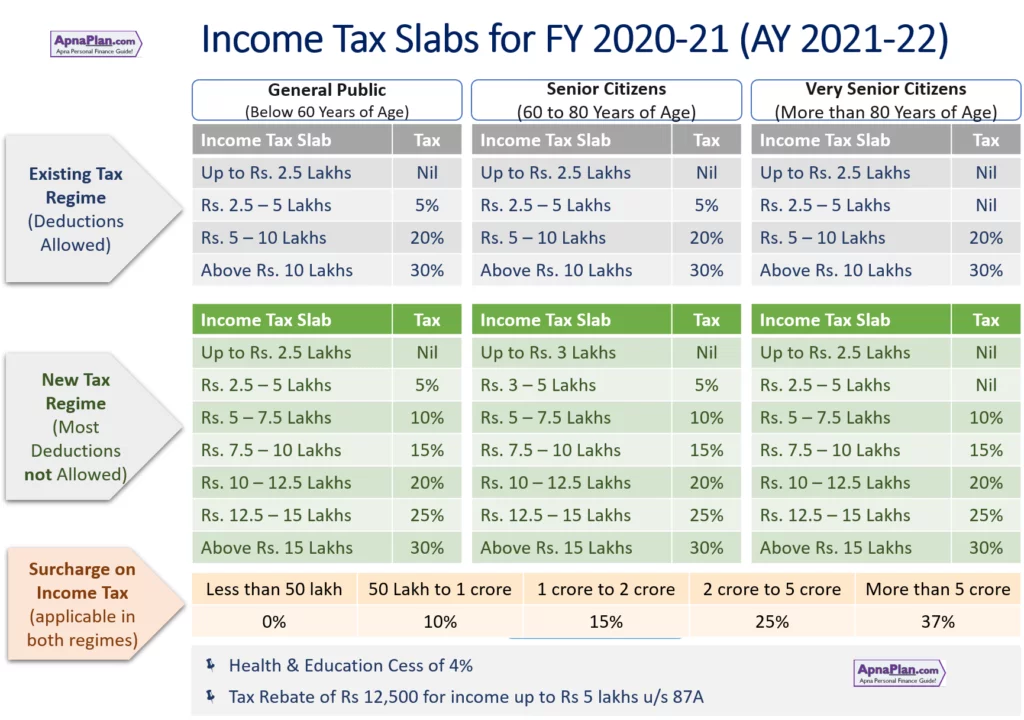

And depending on how long you own the stock that income could be taxed at capital gain rates ranging from 0 to 238 for sales in 2021typically a lot lower than your. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Section 1256 options are always taxed as follows. This calculator illustrates the tax benefits of exercising your stock options before IPO. Please enter your option information below to see your potential savings.

Incentive Stock Option exercises. The tax rate on long-term capital gains is much lower. ISO startup stock options calculator.

The IRS taxes capital gains at the federal level and some states. The following table shows an example of how much stock option values would be at various growth levels for an employee who annually obtained. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes.

The grant of the option the exercise of the option and the sale of stock acquired through the. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Lets say you got a grant price of 20 per share but when you exercise your.

Locate current stock prices by entering the ticker symbol. Employee Stock Option Calculator. Even after a few years of moderate growth stock options can produce a.

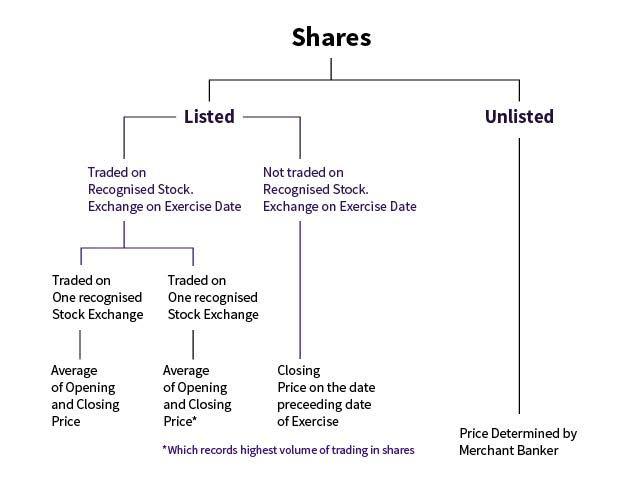

Unlike ISOs holders of non-qualified. For this type of stock option there are three events each with their own tax results. Understanding Your Stock Option Benefits.

The stock options were granted pursuant to an official employer Stock Option Plan. 40 of the gain or loss is taxed at the short-term capital tax. ISOs can flip to NSOs.

Try Our Free Tax Refund Calculator Today. Your basis in the stock depends on the type of plan that granted your stock option. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

The profit you make when you sell your stock and other similar assets like real estate is equal to your capital gain on the sale. However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and the current. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit.

Ad Helping You Avoid Confusion This Tax Season. If you sold the stock options during the tax year your selling price is the gross proceeds you received from the sale of the stock options less any costs associated with the. But those rates also apply to the gains youve realized from the sale of a capital asset like stock that youve owned for one year or less.

60 of the gain or loss is taxed at the long-term capital tax rates. The Stock Option Plan.

Private Company Stock Options Eso Fund The Private Company Stock Option Possessors Like The Employees Founders And O Stock Options Private Company Cash Out

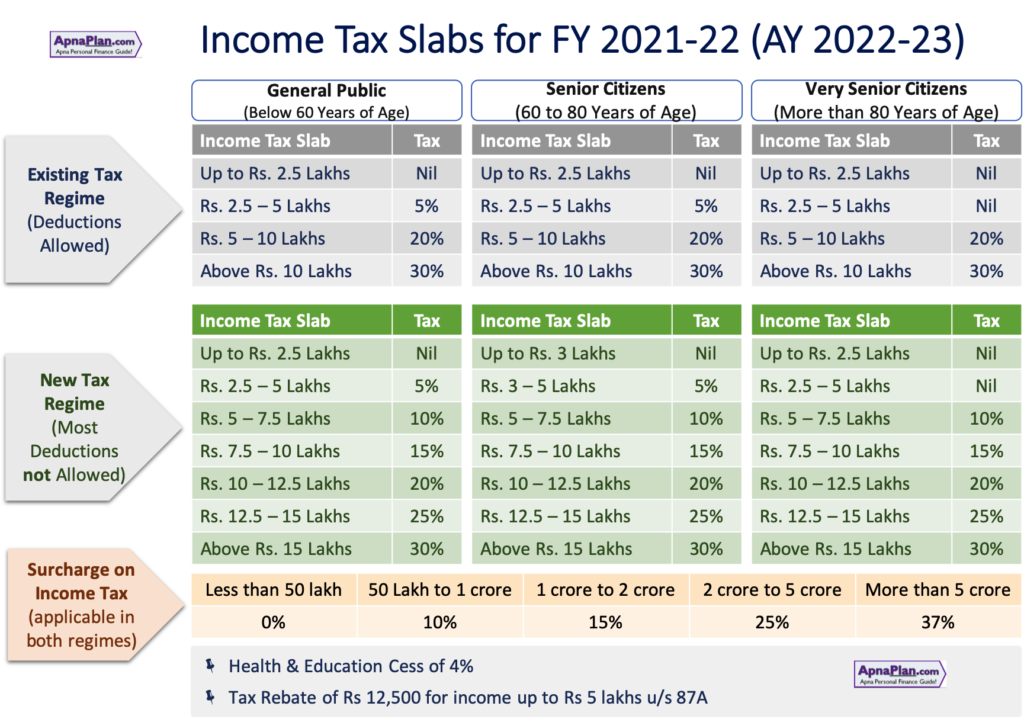

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Uk Taxation On Shares Example Forex Trading Forex Trading Brokers Forex Trading Training

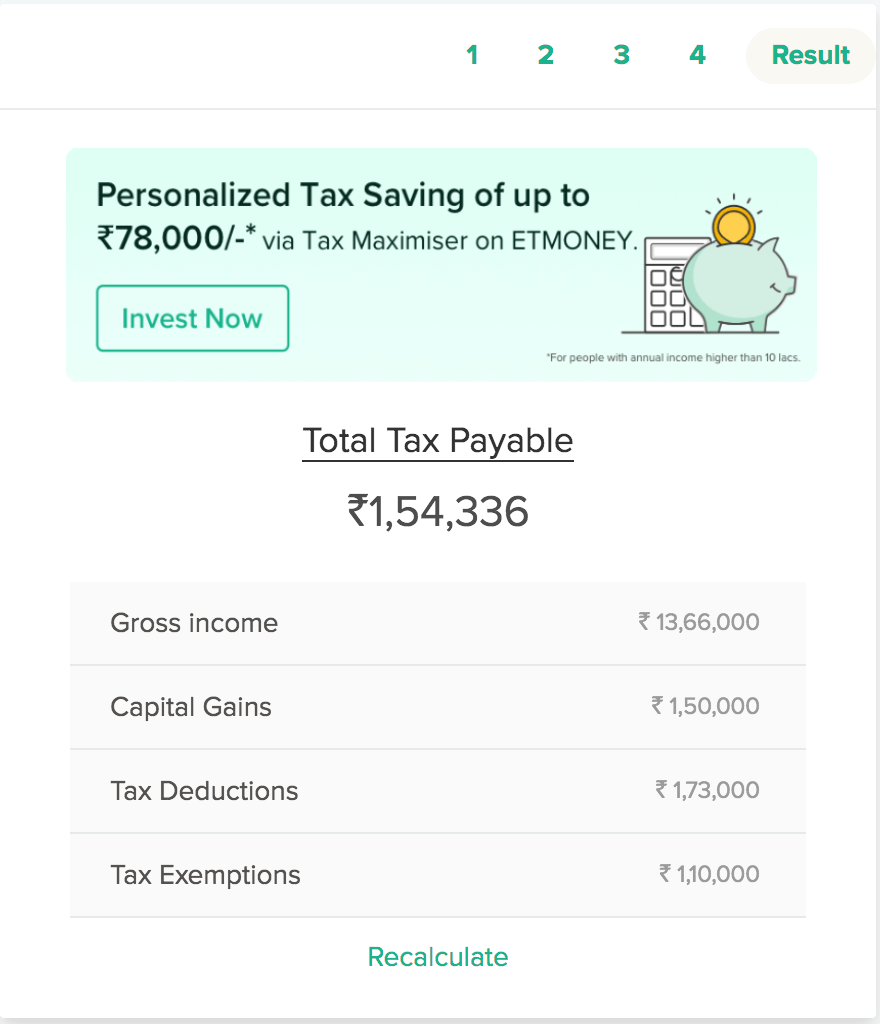

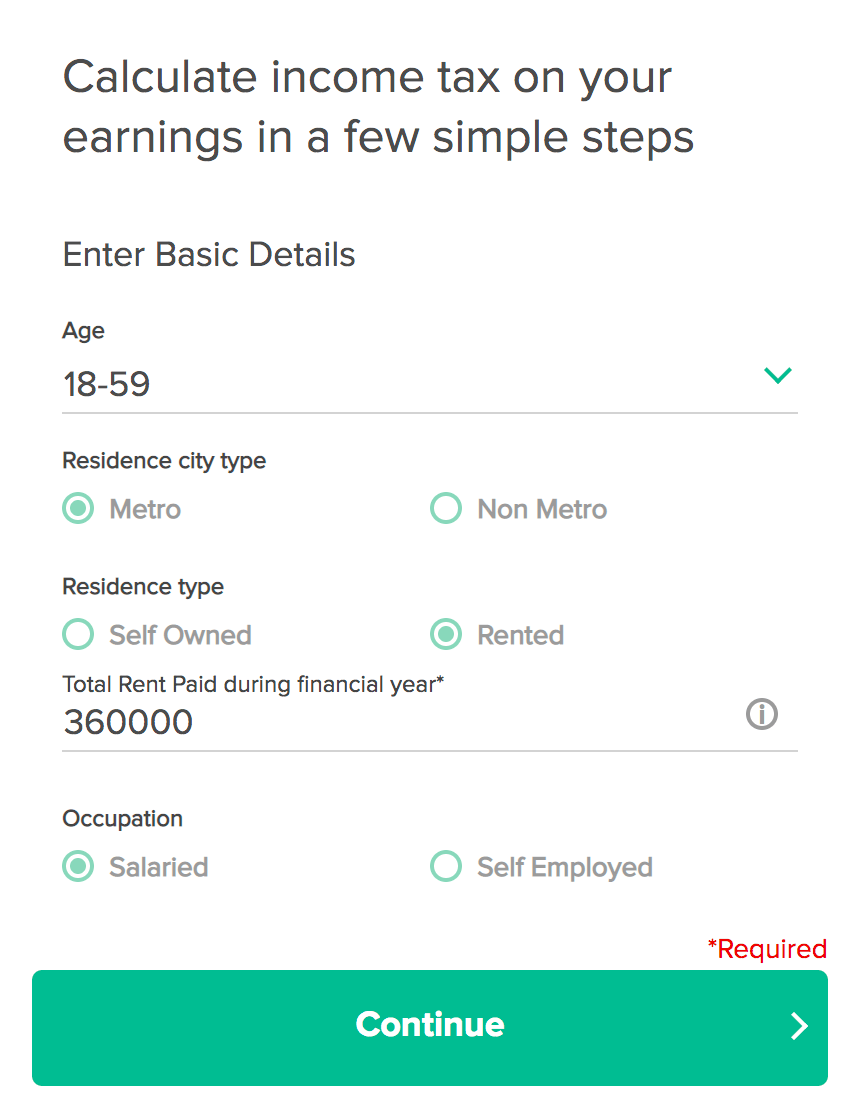

Income Tax Calculator India Calculate Your Taxes For Fy 2021 22

How To Calculate Sales Tax Video Lesson Transcript Study Com

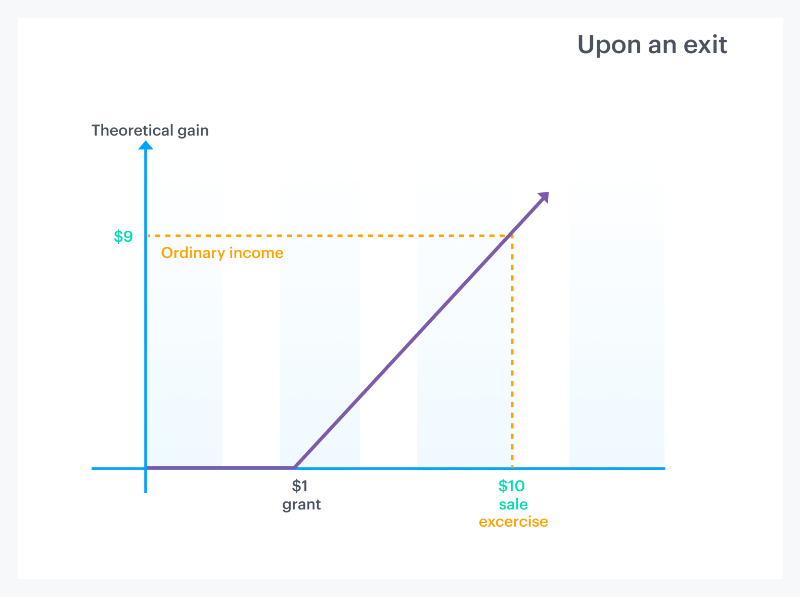

Equity 101 How Stock Options Are Taxed Carta

Latest Income Tax Slab Fy 2021 22 Ay 2022 23 Budget 2021 22 Review Income Tax Tax Income

Income Tax Calculator India Calculate Your Taxes For Fy 2021 22

Reverse Sales Tax Calculator 100 Free Calculators Io

Automatic Discount Calculation In Tally Advance Setting In Tally Erp 9 Personal Finance Finance Automatic

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

Getting Esop As Salary Package Know About Esop Taxation

How To Calculate Sales Tax Sales Tax Tax Calculator

How Do Sales Costs Of Dsts Compare With Traditional Real Estate Investing Corporate Bonds Selling Real Estate

Capital Gains Tax Calculator For Relative Value Investing

Locating And Discovering Sales Tax Medical Icon Sales Tax Medical

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Long Term Capital Gain Tax Calculator In Excel Financial Control

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-f215806b843b4874ae6e1a0481724d7d.jpg)